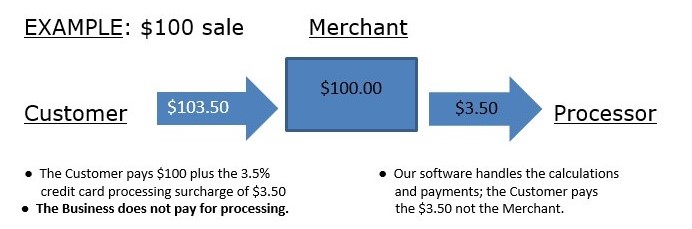

New Jersey Zero Cost Processing Analysis Example

As this simple New Jersey zero cost processing analysis example shows, even small businesses can save thousands of dollars each year in credit card processing fees. Over forty states now allow "zero cost credit card processing" also known as "zero fee credit card processing". New Jersey, Pennsylvania, California, Nevada, Rhode Island and Florida are just a few of the states that allow merchants to pass on the credit card processing fees to their customers. We advise businesses on how to properly use a zero fee program so they are within state guidelines as well as the rule established by the major credit card brands.

Some business sectors that surcharging seems to fit well with include automotive services, body shops, auto repair shops, dry cleaners, dental practices, veterinarian clinics, animal hospitals, pet care stores, liquor stores and wine stores.

New Jersey Surcharging Analysis Breakdown

The Business Nets $100 on a $100 Sale.

The Business Saves Thousands of Dollars a Year.

Cost Savings Example: A Business paying $800.00 each month in credit card processing fees would only pay $60.00 plus fees for accepting debit cards, saving about $700 monthly and over $8,000 yearly.

While the business is passing the credit card processing fees onto the customer pro rata based on the amount of their purchase, there are some monthly fees the business will be required to pay, which are set forth below

- Standard Monthly Fees: Monthly Statement Fee $10.00 PCI Compliance Fee 15.00 Credit Card Terminal 35.00 Total $60.00

We only use approved software and advise our clients on the proper notices and procedures they must follow, most of which is handled by our software. For instance, merchants cannot impose a surcharge on customers that pay using a debit card and our software and approved terminal distinguishes between the various card types so only credit cards are surcharged. If you would like us to review your last merchant processing statement and do a New Jersey surcharging analysis to estimate what your business will be saving, we are happy to oblige.

What About Processing Fees and Card Association Fees?

Credit Card Processing Fees

No, your business will not have to pay any "credit card processing fees" although as stated above you will have some fixed monthly costs as well as a variable cost for processing debit cards, if your business accepts debit cards. Just to keep things clear, "credit card processing fees” are the fees charged by the acquiring bank or merchant’s processing bank. There can actually be three separate fees charged for processing the transaction, which are an authorization fee, discount fee and transaction fee, although some sales agents in the industry like myself do not charge a transaction fee because we fee it is double dipping and not transparent to the merchant. Authorization fees on each sale should only be a few cents and discount fees should be stated as basis points, which are fractions of a percent. Example: 50 basis points equals .005 or one-half of a percent. Still, these fees add up to thousands of dollars each year that the merchant is paying which reduces their net profits.

Debit Card Processing Fees

Debit card processing fees are typically lower than the processing fees charged for credit cards, especially corporate cards and rewards cards. Customers use them to get those benefits and "rewards", but really don't understand how much their local merchant is paying on the processing side so the customer can get those "rewards".

Card Association Fees

Card association fees are sometimes confused with interchange fees, but they are separate. Card association fees are those fees charged by Visa®, MasterCard®, Discover®, American Express®, network cards and other card brands (“Card Brands”) directly to merchants through the merchants’ bank also known as the acquiring bank. All businesses accepting credit cards must pay these fees. Card association fees are paid directly to the Card Brands and are used to fund their business and operations. These fees include but are not necessarily limited to costs and expenses related to licensing, regulatory matters, patents and copyrights, national and international settlements, and authorization software and systems, the interchange network, product development, advertising and marketing, as well as risk assessment and management services of the Card Brands.

I hope this New Jersey zero cost processing analysis example has explained how businesses can save significant amounts eliminating their credit card processing fees. If you should have any questions or feel that you would like to implement a surcharging business for your business, please feel free to reach out to me anytime. There are no multi-year lockup agreements and no early termination fees to worry about. You can try the program for a month or even two before you decide to cancel with your current processor.

Powered by NXGEN Payment Services, a Registered MSP/ISO of Elavon, Inc. Georgia.