New Jersey Zero Cost Processing Analysis

|

The New Jersey Zero Cost Processing Analysis below sets forth the requirements for zero cost processing in New Jersey and shows how much businesses can really save, which is usually thousands of dollars each year, even for a small business. |

New Jersey, California, Pennsylvania and many other states now allow businesses to pass the credit card processing fees onto the customer as long as certain disclosures are made and proper procedures followed.

New Jersey Zero Cost Processing Analysis Savings

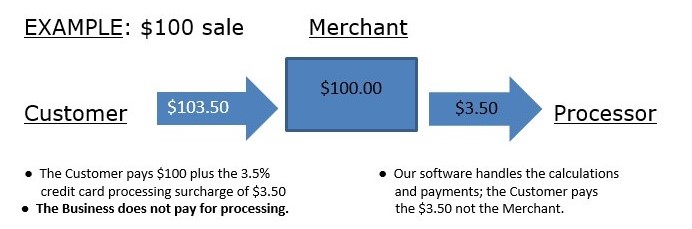

The Business Nets $100 on a $100 Sale.

The Business Saves Thousands of Dollars a Year.

Cost Savings Example: A Business paying $800.00 each month in credit card processing fees would only pay $60.00 plus fees for accepting debit cards, saving about $700 monthly and over $8,000 yearly.

The standard monthly fees are set forth below. The amount you pay each month for debit card processing depends on the amount of debit card transactions each particular month, so it varies each month. Based on the Credit Card Association rules, businesses are not allowed to pass debit card processing fees onto the customer.

- Standard Monthly Fees: Monthly Statement Fee $10.00 PCI Compliance Fee 15.00 Credit Card Terminal 35.00 Total $60.00

We were on of the first to help businesses understand this program and properly use it; some sales agents either don't know about this program or do not have a contract to sign up merchants for zero cost processing.

Can My Business Try Zero Cost Processing Before Fully Committing?

Yes, we do not require a multi-year lock-up and we do not charge a termination fee if your business decides at any time, they would like to switch back to a regular credit card processing arrangement. It is actually a good idea t test the waters first and we are glad to help you every step of the way.

Merchants can now save significant amount by passing on the processing costs to their customers. This not only lowers their monthly costs, but also helps improve their profit margins. This can be especially beneficial to small business owners such as restaurants trying to increase their profits without skimping on ingredients or the size of their portions.

Even people that run a service business can benefit from this type of program and we are glad to help do a simple New Jersey zero cost processing analysis using their current credit card processing numbers to show them how much they could be saving. Our program software works in certified EMV credit card terminal, or you can even enter the credit card information on a smart phone or computer through a secure payment portal. Feel free to contact us for more information.

Powered by NXGEN Payment Services, a Registered MSP/ISO of Elavon, Inc. Georgia.